When preparing for a long trip, one of the most frequently asked questions is: how much cash can you travel with on a plane? It’s far from a trivial concern. Beyond the practical aspects of handling first expenses upon arrival, there are also strict legal regulations to consider, set by customs authorities. Understanding these rules—and how to plan accordingly—helps travelers avoid surprises, fines, or delays at the airport. Let’s dive into the topic.

Legal limits on carrying cash on a plane

European and international regulations establish clear limits on the amount of cash travelers can carry on flights. In general, within the European Union, you’re free to travel with up to €10,000 in cash. If you exceed that amount, you’re required to declare it to customs authorities, both when entering and exiting a country.

The same principle applies in non-EU countries like the United States, Canada, UAE, Thailand, or Japan—although specific thresholds and declaration procedures may vary.

Some countries allow entry with amounts exceeding the €10,000 equivalent but require a detailed declaration. Others enforce strict maximum limits. For example, India only permits travelers to carry up to 25,000 rupees (around €280) in cash upon arrival. In Thailand, the undeclared cash limit is approximately $20,000 USD.

How much cash should you take when traveling?

Aside from the legal thresholds, the real question most travelers ask is: how much cash should I carry on a plane to comfortably handle the first expenses abroad?

The answer depends on factors such as your trip’s duration, the cost of living at your destination, your spending habits, and the availability of other payment methods. Still, it’s always a good idea to travel with a minimum amount of local currency already exchanged, to avoid hassles upon arrival—especially when ATMs are not easily accessible or exchange desks are closed (as can happen during night landings or at smaller airports).

Depending on your destination, a budget between €100 and €500 in local currency is typically enough to cover:

- Transportation (e.g., taxis, trains, shuttles)

- Food, drinks, local SIM cards, tips

- Emergencies or security deposits (e.g., for hotels or car rentals)

Traveling with a small amount of local currency also helps you avoid high and unclear foreign ATM withdrawal fees.

The easiest way to get foreign currency

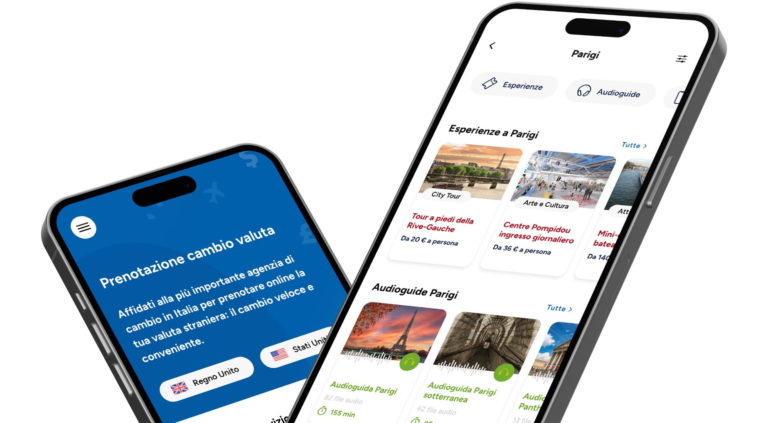

If you’re wondering how to get foreign currency easily, safely, and affordably, the answer is: book your online currency exchange with Forexchange.

This service lets you:

- Choose the desired currency in advance, from over 60 international options

- Lock in the exchange rate in real time

- Pick up the cash from the most convenient location—either near home or directly at the airport

Key benefits include:

- No additional fees on the booked exchange

- Mobile booking available anytime, anywhere

- Peace of mind, knowing you have the right amount of cash before departure

Just like booking your flight or hotel, planning your currency exchange in advance is now part of smart travel prep.

Practical tips for flying with cash

While carrying cash on a plane isn’t illegal, it requires some precautions. Here are two essential tips:

- Always declare amounts above €10,000: Failing to do so may result in confiscation of the undeclared funds and heavy fines. It’s better to fill out the required declaration form in advance, available on the websites of customs authorities (such as Italy’s Agenzia delle Dogane).

- Distribute your cash wisely: Avoid putting all your money in one wallet. Split it across hand luggage, interior pockets, or a backpack to reduce risk in case of theft or loss.

It’s also a good idea to keep the receipt of your currency exchange. This can help explain the origin of your funds during inspections.

What if you need more cash abroad?

Unexpected expenses can happen: a medical emergency, a lost ticket, or an important purchase. If you don’t have enough money on hand—or have maxed out your card—it’s helpful to rely on a fast, secure service like Western Union® Money Transfer offered by Forexchange.

Thanks to the global Western Union® network, you can receive funds from anywhere in the world within hours, in cash or via direct deposit. It’s a reassuring solution—even in emergencies.

Balancing safety and practicality

Ultimately, carrying cash on a flight is legal and advisable, as long as you follow the rules and take some basic precautions. Having a modest amount of local currency helps make the start of your journey smoother, lets you handle initial expenses confidently, and gives you greater freedom of movement.

With Forexchange’s travel services, you can organize everything ahead of time: book your currency online, pick it up at the nearest Forexchange branch, and set off with zero stress.

To manage everything even more easily, download the Forexchange app, available for both Android and iOS.