Travel is about discovery, freedom, and unforgettable experiences. Exploring new destinations, immersing yourself in different cultures, and creating lasting memories are all part of the journey. However, even the most carefully planned trips can be affected by unexpected events. Medical emergencies, cancelled flights, lost luggage, or sudden changes to travel plans can quickly turn an enjoyable experience into a stressful one.

This is where travel insurance plays a key role. It helps travellers manage uncertainty by offering protection, assistance, and financial coverage, allowing them to focus on their trip with greater peace of mind.

How travel insurance works

Travel insurance is a contract between a traveller and an insurance provider. By paying a premium, the traveller gains coverage for a range of unforeseen events that may occur before departure or during the trip. Coverage usually begins on the date of purchase and remains valid for the entire duration of the journey.

In the event of a problem—such as a medical emergency abroad, a cancelled flight, or lost luggage—the insured traveller can access assistance services or submit a claim, depending on the situation. This support helps reduce both the financial burden and the practical difficulties caused by unexpected events.

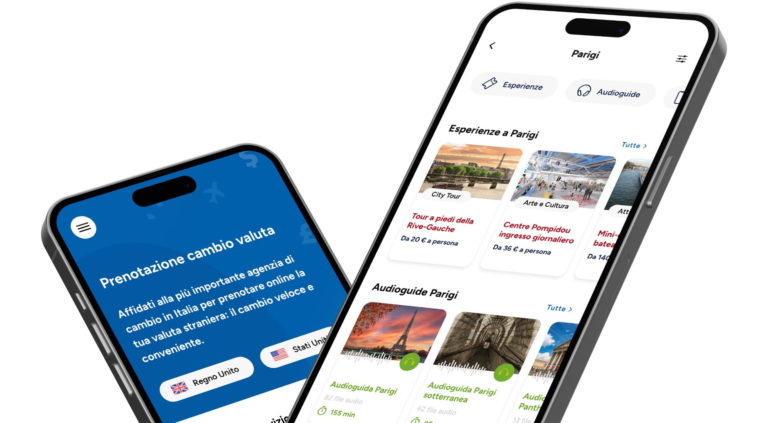

With Forexchange, travel insurance can be booked online before departure, making it easy to secure coverage in advance and start travelling with confidence.

What travel insurance typically covers

While coverage may vary depending on the policy, most travel insurance plans include several essential areas that address the most common travel risks.

Medical assistance and healthcare expenses

Healthcare costs abroad can be extremely high, particularly in countries with private healthcare systems. Travel insurance usually covers:

- Emergency medical treatment

- Hospitalisation and surgical procedures

- Medication prescribed during the trip

- Medical evacuation and repatriation, when required

This type of coverage ensures that travellers can receive prompt medical care without facing unexpected or unmanageable expenses. In many cases, insurance providers pay hospitals directly, reducing the need for upfront payments.

Emergency assistance and support

Most travel insurance policies include 24/7 assistance services, which are especially valuable when travelling in unfamiliar countries. Assistance typically covers:

- Support during medical emergencies

- Coordination of hospital admissions or emergency transport

- Help with legal or procedural matters following accidents or unexpected incidents

Having access to professional assistance at any time can make a significant difference, particularly when language barriers or local regulations complicate the situation.

Lost, stolen, or delayed luggage

Luggage-related issues are among the most common travel inconveniences. Travel insurance can help by:

- Reimbursing lost, stolen, or damaged baggage

- Covering essential purchases if luggage is delayed

- Providing guidance when dealing with airlines or transport providers

This ensures that travellers are not left without essential items or forced to bear significant replacement costs.

Trip cancellation or interruption

Unexpected events may require a trip to be cancelled or cut short. Travel insurance typically reimburses non-refundable expenses in cases such as:

- Illness or injury affecting the traveller or a close family member

- Severe weather events or natural disasters

- Travel restrictions or other serious emergencies

This protection allows travellers to recover prepaid costs that would otherwise be lost.

Why travel insurance is a smart choice

Travel insurance is not just a precaution for long or complex journeys. Even short trips can involve risks. The main benefits include:

- Financial protection against medical emergencies, cancellations, and disruptions

- Professional support to manage unexpected situations efficiently

- Peace of mind, allowing travellers to focus on enjoying their experience

- Better travel planning, by reducing uncertainty and potential stress

Travel insurance works best when combined with other essential travel preparations, such as managing currency, connectivity, and travel services in advance.

Coverage options for different travel needs

Travel insurance can be tailored to suit different travellers, destinations, and travel styles. Forexchange offers three main coverage levels, designed to address a wide range of needs.

Easy Level

Includes 24/7 assistance, hospital and surgical expense coverage, and support for family members at home in case of emergencies.

Smart Level

Includes all Easy benefits, plus luggage protection, accident coverage, and legal or procedural assistance.

Top Level

Includes all Smart benefits, plus compensation for missed flights or connections and trip cancellation coverage due to serious events.

These options allow travellers to choose the level of protection that best matches their journey and risk profile.

More services to support your journey with Forexchange

In addition to travel insurance, Forexchange provides a complete range of services designed to support travellers before and during their trip. Travellers can book foreign currency online in advance, securing cash at competitive rates before departure. International eSIM ensure reliable connectivity abroad without the need to worry about roaming charges.

Forexchange also offers tax refund services for non-EU travellers shopping in Italy, simplifying the VAT refund process, as well as audioguides for major Italian destinations, ideal for those who want to explore cities independently while learning more about local history and culture.

By bringing together insurance, currency exchange, connectivity, and travel services in one place, Forexchange helps travellers plan more efficiently and travel with greater confidence.

Travel with confidence

Travel insurance is an essential part of responsible travel planning. It provides reassurance, financial protection, and practical assistance when unexpected situations arise.

With Forexchange travel insurance, travellers can easily choose the right coverage and combine it with other essential travel services. Planning ahead with Forexchange means travelling safer, smoother, and better prepared—so you can focus on what really matters: enjoying the journey.